How To Obtain Voters Registration Card Already Registered

Obtaining a merchant account might be both expensive and challenging. This is specially true for service providers, small-scale concern owners, and contained contractors. Notwithstanding with the challenges and the expense that come up with obtaining a merchant card, more than and more people are using credit cards to make purchases every day. This makes people want to know of other alternatives on how to take payments without a merchant account. The question is whether it is possible to accept payments without a merchant account?

The answer is yep, it is possible to get credit card payments without necessarily having a merchant account. Owning a merchant account is no longer the only option on the table, all thanks to 3rd-party payment gateways. In this commodity nosotros lay out what is the merchant account requirements and provide a list of 8 alternative ways to accept credit card payments.

What a merchant business relationship is and how it works

Permit'due south clarify what merchant account is showtime. A merchant account is a type of banking company account. It allows merchants to accept credit card payments online. How does a merchant account piece of work? The unabridged process includes half dozen stages:

- Client purchases products/services on your website.

- Your credit card processor sends the transaction to the credit menu network (Visa or MasterCard).

- The credit card network then routes it to the customer'southward issuing bank for approval.

- In one case approved, the transaction funds are deposited into your merchant business relationship.

- Then the credit bill of fare processor transfers the funds from your merchant business relationship to your business bank account.

- Then, and only then, yous tin can use your money.

The first four stages take no longer than a few seconds. The fifth stage, though, ordinarily takes from two up to 14 days. Yep, you lot've heard it right. It might take you two weeks to use the difficult-earned money. That'due south ane of the reasons why some people prefer to utilize alternative means to have credit menu payments (more on them beneath).

What are the requirements to become a merchant account

To open up a merchant account in 2020, you need to provide the post-obit documents:

- Certificate of Incorporation;

- Document of incumbency;

- Local documents as per visitor jurisdiction which displays company directors and owners;

- Utility bill/Banking company statement/Rental agreement nether corporate names proving company location;

- Valid ID copies for all company directors and owners.

In that location are also specific website requirements you lot accept to stick to. Otherwise, your website won't compile with all the Visa, and MasterCard demands. In such a case, your awarding won't exist canonical. Another website requirement is to create Terms & Condition and a Privacy Policy folio.

How to accept credit carte payments without a merchant account

The merchant applying process is not as complicated as information technology seems. Yet, it may have a long time to become through the paper difficulties. Service providers' verification steps could be extensive as well. They vary from the quality of your documents, site performance(if one), type of business organisation, and others. Don't want to open up a merchant business relationship?

Using an intermediary is the solution for you lot.

A payment aggregator acts as an intermediary. It is a service that collects all online funds received on account of a website, an online shop, and and then transfers them to the accounts of the customer company. It is what allows y'all to work not simply with cash on delivery simply also quickly constitute electronic payment acceptance.

When choosing a payment aggregator, consider the following factors:

- Security.

Payment security should exist a priority for any merchant.

Therefore, when choosing a payment system, y'all must exist sure that it can provide the necessary level of protection. Security methods may vary:

- Instant potency of the customer.

- Encryption of financial information on the Internet;

- Special certificates.

- Payment flexibility.

- The company must take a transparent payment policy. Also, be aware of subconscious fees.

- The flexibility of recurring payments.

- Does the company provide financial statements?

- The convenience of contacting customer back up.

The possibility of quick contact past phone, live conversation, email or other preferable for customer methods. Support must promptly resolve problems.

- The limitations on the maximum amount of card payment.

- The convenience of the interface both for clients and merchants.

6 proven ways to have credit card payments without a merchant business relationship

The majority of these payment aggregators offer online services and each one of them comes with its own pros and cons. All in all, these platforms make payment transactions much easier than they ever were before and they save small business people the desperation of opening merchant accounts.

-

PayPal

PayPal is by far one of the near common and largest payment processors in the world. It rose to its prominence later on collaborating with eBay and many other online merchants. All you need when using PayPal is the details of your debit or credit carte and your bank account. From at that place you become your ain secure information virtually your PayPal account that you lot do not accept to share with anyone.

Signing upwards with PayPal is complimentary and it does not require any annual membership fees. You lot also practise not pay whatsoever processing fees or service charges. If you are a modest business possessor, you never have to worry almost the challenges of opening a merchant account.

The benefits of using PayPal are:

1. Credit card security. Since you don't disclose your personal banking information, your account cannot be hacked.

2. Flexibility. You will never have to face the agony of having your credit menu declined. With PayPal, yous tin accept several depository financial institution accounts as well as credit and debit cards linked to them. If the start endeavor fails, PayPal will request funds from your other accounts depending on your order.

iii. It's gratuitous. PayPal is free of charge, and at that place are no almanac membership fees.

4. Instant international transactions. You tin transport or receive money in almost any country in the world. The transfers are instant, and you can check your balance with one click. This makes it significantly improve than other costly payment methods like Western Union.

-

Square

Square is the number 1 choice for pocket-size concern owners. It does not require much paperwork and the fees charged are minimal. The Square, which is a card-swiping device, turns your smartphone or tablet into a cash register. The card connects with the device of your selection to carry out all kinds of payments. The companies' services are particularly popular in street food stands, restaurants, coffee shops, and many other modest businesses. Through their Greenbacks App, y'all receive payments also as electronic invoices. Probably the chief advantage of using the platform for entrepreneurs will exist synchronization with the POS organisation of outlets. You tin have both chip cards and NFC payments for contactless or traditional operations with fries and pivot codes. Moreover, you tin admission your income the very next business mean solar day after the payment.

-

Skrill

Skrill is the best culling to PayPal. Some of the features that make Skrill stand out are its instant deposits and withdrawals. The transaction fees are minimal making it perfect for minor business organisation owners. With Skrill, you can likewise send text messages from your business relationship. The system process payments in xl currencies. Skrill also has an incredible referral program that allows yous to collect 10% of all the friends' transactions. To use this payment system, you practise not need to install anything on your computer – no programs, plug-ins, etc. A typical browser and Internet access are plenty.

The entire interface is on the official website of the company. Moreover, for personal not-commercial accounts, there is no commission for using the system. The just limitation of Skrill is age. Information technology is impossible to annals in the system if your age is less than 18 years.

The security service scrupulously checks all user information. Therefore, if you enter incorrect data, your account volition be blocked. -

Google Wallet

If you do non have a merchant business relationship, you can also employ Google Wallet to receive your payments. Google Wallet is another pop online payment service that is simple to use, prophylactic and very fast. You can utilise your smartphone to deport out your transactions using Google Wallet. The service as well allows you to connect debit, credit, gift and loyalty cards to your business relationship.

Google tech experts claim that when you pay at a store, Google Wallet does not provide your real card details to anyone. Instead, the store receives a unique encrypted number. This approach allows you to keep information about customer payment information secure. Besides, the service has a smart hallmark function, which enables you lot to determine whether the device is in a safe state and decides whether to request data from the user to unlock the screen.

To pay for appurtenances using this service, your smartphone must have an Android platform version 4.4 and higher. Also, NFC wireless engineering is a must. -

Stripe

Stripe has been around for a couple of years now, and it is another mode of accepting payments without opening a merchant account. It has a flexible and powerful API that makes all transactions easy to make.

The flexibility allows you to tailor the Stripe platform to your needs. It is easily integrated with many other applications, which means that even if yous are non tech-savvy, you lot can comfortably start using information technology to do your business. It has no gear up-upward, or monthly fees likewise every bit any other hidden costs. Small business concern owners that discover it hard to open up a merchant account will definitely dear this easy-to-use platform. -

Apple Pay

Another option to accept into account if you don't desire to open a merchant account simply want to process online payments is Apple Pay. All you demand to offset receiving online payments is a impact ID confirmation. This ways that simple payment processing is literally at your fingertips. Though the platform needs a lot of improvement, it is by far ane of the fastest-growing payment systems.

You lot might also like Top 10 PayPal alternatives

How to accept alternative payment methods without a merchant account

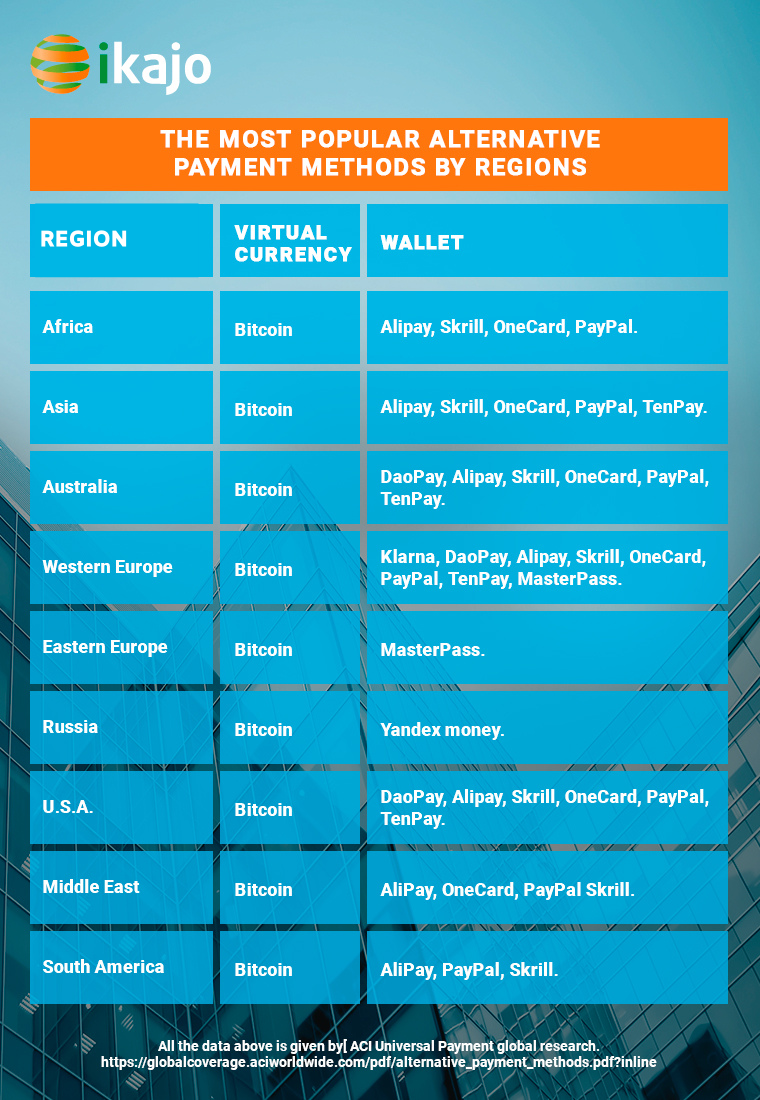

Visa and MasterCard payments are traditional. However, you should not underestimate the alternative payment methods. Alternative payment methods are cardless and cashless means of paying for products and services online. As stated by Industry data, upward to 55% of global transactions will be made via alternative payment methods by the end of 2019. Check out the list of the most pop alternative methods by region.

The good news is, you tin can accept culling payment methods without a merchant account.

Wrapping it upwardly

Certain matter, merchant account holders have access to a large number of advanced payment methods but the approval time can exist a real hurting in the neck. Depending on the payment service provider, information technology might take weeks to get approval to open a merchant account. Besides, it is as well expensive, peculiarly for pocket-size concern owners. Third-party gateways offer the all-time alternative to merchant accounts. Though they might not come with the same advanced payment tools and services, they are affordable, fast and secure. They too give merchants the option of managing the transactions using their mobile devices. Gateways without mobile reader solutions offer the same services via a website.

When choosing a service for accepting payments, pay attention to the simplicity of the process for connecting a payment aggregator, the convenience of the interface of your business relationship, and the time for crediting payments. An important factor is likewise the security of cash flows passing through the service.

Therefore, if you are starting upwards a business organisation or are all set to run your own business simply cannot afford to open a merchant business relationship, the platforms above will show you several means how to accept credit bill of fare payments without a merchant business relationship.

Source: https://ikajo.com/blog/accept-payments-without-merchant-account

Posted by: templetondenard.blogspot.com

0 Response to "How To Obtain Voters Registration Card Already Registered"

Post a Comment